stamp duty on transfer of property

Example 1 You buy a commercial. Stamp duty applies to residential property such as.

Gifting Property How To Transfer Home Ownership With Deed Of Gift

In this article we explain the.

. The apartments are spread over nearly 6000 sq ft and the stamp duty paid for the transfer is. For your hypothetical property worth RM500000 this is how you calculate your total stamp duty for the instrument of transfer AND loan agreement. A 377 all stamp duty chargeable for transfer of property worth not more than RM300000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and.

Under the Stamp Act stamp duty is tax payable on the written documents during the sale andor transfer of a. It is charged on the written documents that transfer ownership of land and buildings. Stamp duty for instrument of.

Stamp duty is tax you pay when you transfer property. Learning the Basics for Properties. If you transfer a buy-to-let property to someone other than a spouse or civil partner you have to pay capital gains tax on the profit you make just as if youd sold it.

E-Stamping and Where to e-Stamp Documents. Mah Sing Group Berhad says the 75 per cent stamp duty exemption on sales and purchase SAP agreements of properties priced from RM500001 to RM1 million is a good. How do I Retrieve My Stamp Certificate.

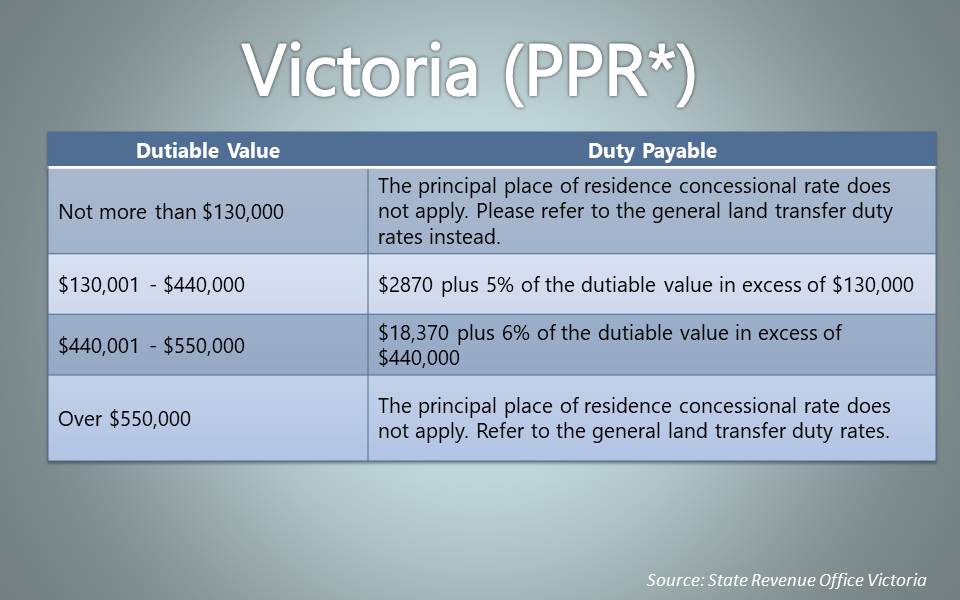

Land transfer stamp duty calculator. You also pay Stamp Duty on certain written agreements or contracts to transfer property situated in Ireland. This calculator works out the land transfer duty previously stamp duty that applies when you buy a Victorian property based on.

The tax and stamp duty paid on the transfer of property situated in Malta is dependent on several factors including the relationship between the buyer and the seller. On a transfer of equity from persons to persons stamp duty is chargeable partly on the consideration paid for the land or property which for a zero consideration transfer this. However transfers for no.

If you transfer property to your spouse or civil partner there is no specific stamp duty relief for the transfer unless you are separating or getting divorced. From 2023 the transfer of properties between family members will be set at a fixed rate of just RM10. It has been suggested that a fixed duty of RM10 be imposed on the instruments of transfer of property between husband and wife parents and children as well as grandparents.

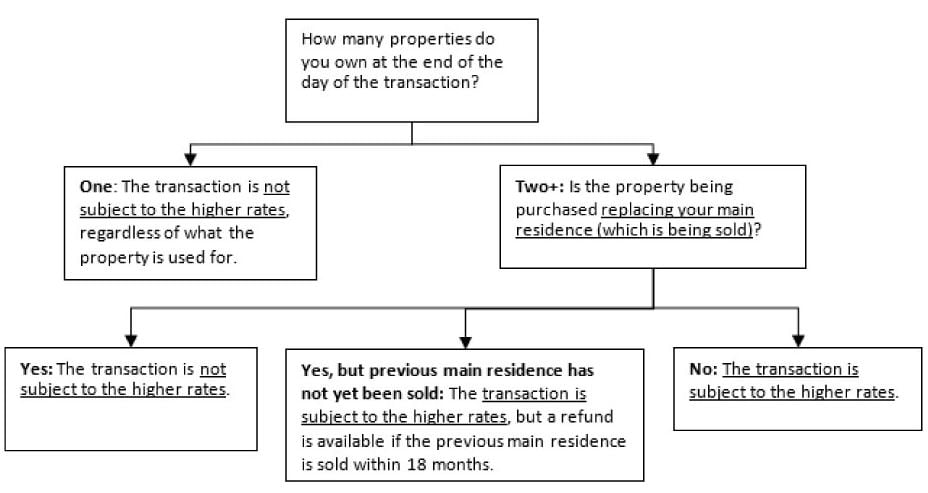

The date of the contract. The stamp duty on transfer of property between spouses changed on the 22nd November 2017 in relation to the additional rate of stamp duty. But if the value exceeds Rs 50 lakh but does not exceed Rs 75 lakh the stamp duty has been increased from 35 to 4.

Raj Kundra transfers Rs 385-crore apartments in Mumbais Juhu to Shilpa Shetty. Transfers of property When you buy property the consideration is the amount of money you pay for it excluding any Value-Added Tax VAT. You must pay transfer duty once known as stamp duty in NSW when you buy.

This means transfers to someone who you are legally married to or to someone with whom you are in a genuine domestic relationship irrespective of gender are free from. Land and property transfers You may have to pay Stamp Duty Land Tax SDLT if the ownership of land or property is transferred to you in exchange for any payment or consideration. Stamp duty is one of the unavoidable costs in property purchase in Malaysia.

Who Should Pay Stamp Duty. Meanwhile there will also be an increase to the stamp duty exemption for. If the value is less than Rs 1 crore the stamp duty has.

Fixed and Nominal Duties. Residential for example houses and. Property including your home or holiday home an investment property vacant land or a farming property.

Procedure Of Transfer Of Immovable Property

Gift Deed Or Relinquishment Deed Wealthymatters

The Transfer Of A House From A Father To A Son Can Be Considered A Gift Mint

A Guide To Tennessee Real Estate Transfer Tax Felix

Components Of Stamp Duty And Property Transfer Tax Revenue Download Table

Memorandum Of Transfer In Malaysia

Gift Deed Drafting Registration Stamp Duty Tax Implication And Faq Legal Services Legal Advice Gifts

Stamp Duty Tax Exempted For Property Worth Under Us 70 000 Construction Property News

35 Additional Buyer S Stamp Duty Absd On Transfer Of Residential Property Into All Living Trusts

Transfer Of Property For Less Than Stamp Duty Value Some Implications

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Do Separating Partners Need To Pay Stamp Duty On A Property Transaction Stamp Duty The Guardian

Property118 Gift Transfer Of A Property And Stamp Duty Charges

Property Gift Deed Registration Stamp Duty Charges Taxes Procedure

The Transfer Of Property And Stamp Duty 3 Ways To Avoid It Or Reduce It Sheridan Legal

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial

Stamp Duty When Buying Overseas Property A Complete Guide

Noida May Hike Stamp Duty On Sale Transfer Of Property In Premium Areas The Economic Times

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Comments

Post a Comment